Energy Prices Hit Three-Year Lows

- Mar 12, 2024

- 7 min read

Updated: Jul 15, 2024

UK Energy Market Update

Market Summary

February 2024

February saw a multitude of unplanned outages in Norwegian gas fields and processing plants as well as at UK facilities. These include Norway’s Kollsnes, Nyhamna & Kårstø gas processing plants and Troll, Aasta Hansteen & Skarv gas fields. The UK’s Barrow and Dimlington gas facilities experienced technical issues, while the 1.4GW Viking Link, which connects the UK to Denmark, experienced an unplanned outage. These issues did cause price spikes, but these were tempered by mild temperatures and very healthy EU gas storage. We finished the month with EU gas storage sitting around 63% full, a massive 19 percentage points higher than the 10-year average and a large increase on the 29% that was recorded on the same day in 2022.

LNG imports to Europe are continuing at steady pace, despite the continued tensions surrounding the Red Sea shipping route. This month saw an attack by Houthi rebels tragically claim the lives of three crew members aboard the M/V True Confidence, a Liberian-owned bulk carrier, used to transport dry cargo such as grain and iron ore. Many major oil and LNG suppliers are re-routing their vessels and, in some cases, suspending shipments through the Red Sea. This is leading to increased shipping costs, freight rates, increased shipping times and delivery delays, which also causes uncertainty with regard to security of future supplies.

Net Russian LNG supplies into Western Europe rose in January to their highest level since March 2022. In comparison to previous months, France and Spain were the main buyers of Russian LNG. Russia’s deputy prime minister has stated that it aims to brings its global LNG share up to 15-20% from their current 8%. Russia plans to increase LNG production to 110 million tons in 2030 compared to its 33 million tons in 2023.

Analysts forecast a 50% increase in worldwide LNG demand by 2040. This growth is expected due to the shift of Chinese industries from coal to gas and the growing gas demand in developing nations. Europe is expected to import twice as much LNG, going from 70 million tonnes per year in 2021 to about 140 million tonnes per year by 2030. This rise is driven by long-term agreements ensuring LNG security and the growing demand from Asia, particularly China, and other developing nations.

The UK government has announced its withdrawal from the 1994 Energy Charter Treaty because it hampers efforts to achieve net-zero emissions. The UK joins nine other EU countries, including France and Spain, in leaving the agreement.

Recent data indicates that the EU's industrial gas use is expected to be 22% below average from February to March. Additionally, there has been an 8.7% decline in gas production compared to the previous year, as reported by the EU. The European Commission plans to prolong the EU's target of reducing gas demand by at least 15%, originally set to end next month, until March 2025. They noted that EU gas consumption from August 2022 to the end of last year was 18% lower than the same period in 2021/22.

Last year, the EU installed a record-breaking 16.2 GW of wind power, with 79% of it being onshore, as reported by WindEurope. Wind contributed 19% to the power supply, solar added 8%, and all renewables combined made up 42% of the total. WindEurope predicts that the EU will install an average of 29 GW per year from 2024 until the end of the decade.

The EU energy commissioner, Kadri Simson, informed the European Parliament that there is no necessity to extend the Russian gas transit contract through Ukraine beyond its expiration at the end of this year. Simson suggested that countries still receiving gas through this route, such as Austria, Italy, and Slovakia, have alternative sources available. According to ENTSOG data, last year saw a decrease in Russian gas delivery through Ukraine to Europe, with 13.6 billion cubic meters, down 15% from 2022 and 50% below 2021 levels.

Net Zero News

EU policymakers have approved new regulations to support the local manufacturing of clean tech equipment like solar panels and fuel cells. The aim is to boost EU industry competitiveness against Chinese and U.S. counterparts. The Net-Zero Industry Act (NZIA), set to take effect this year, is a step in the EU's plan to be a leader not just in reducing global greenhouse gas emissions but also in making the necessary equipment.

Voters are worried about Labour's sudden shift in energy investment plans, as revealed in recent polls conducted by Opinium for the Energy and Climate Intelligence Unit (ECIU). According to the poll, 31% of people think that Labour's choice will increase energy bills for regular folks, while only 15% believe it will have a positive effect.

The EU's climate service reveals that global warming has stayed above the 1.5°C threshold for a whole year, surpassing the temperature goal set by world leaders in the 2015 Paris Agreement.

The UK has successfully cut its emissions in half, accomplishing a 50% reduction from 1990 to 2022. During the same period, the economy has grown by almost 80%, making the UK the first major economy to achieve this milestone, as per the latest official statistics.

The Football Association (FA) has teamed up with E.ON to launch a program promoting sustainability in grassroots football. This effort will help clubs cut energy expenses and adopt eco-friendly practices.

The North Sea Transition Authority (NSTA) has started discussions to figure out how to share carbon storage data publicly. This step aims to create job opportunities and help the UK achieve its net-zero goals.

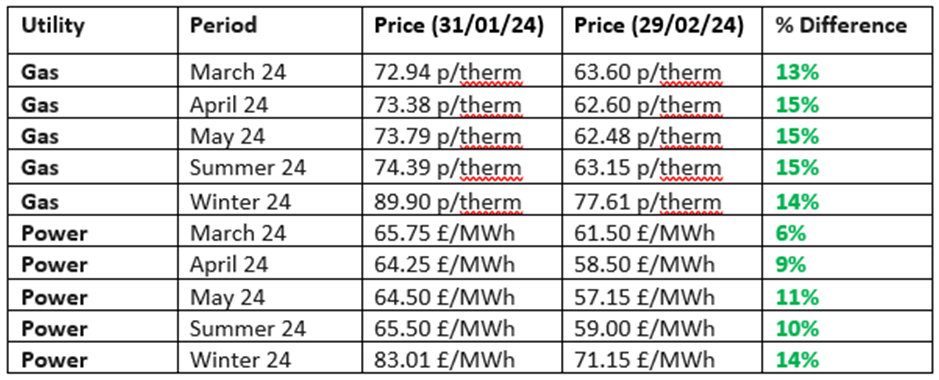

Electricity and Gas Prices

While volatility remains in the market, analysts now believe that price volatility has returned to pre-war levels, re-enforcing confidence in making it through winter in a strong position. While numerous Norwegian outages and geo-political tensions have a bullish impact on the market, this has been tempered by strong LNG delivery, healthy EU gas storage and mild temperatures. All of this meant it was a bearish month for gas and electricity prices as they hit three-year lows in February. Day ahead continues to be the most volatile price point currently, which ranged from 34.07 to 74.99 £/MWh.

Flexible Purchasing

EPEX Price

Some of our flexible purchasing customers are buying on EPEX, a European auction for power. Because they auction every hour of each day, customers get the “market average” price as opposed to a fixed-term contract over e.g. a 12-month period. Being on this product means that you will pay the average of each day for the month and once the market falls the price will follow.

The EPEX price finished the month with an average of 5.94 p/kWh (commodity). With the non-commodity added to this, the overall rate will be around 18.84 p/kWh+.

Carbon Prices

EU carbon continued its weak start to the year, with the price falling a further 13% for the month of February. The closing price for the month at 56 €/tonne was the lowest since July 2021. This is due to weak fundamentals, low emissions due to sluggish economic output, strong renewable generation, and mild weather.

Oil Market

1st - Crude oil prices went up slightly today due to news about possible interest rate cuts in the U.S. and rising demand in China. Powell mentioned that robust economic growth and decreasing inflation could lead to lower interest rates in the upcoming months. Moreover, experts anticipate that China's oil demand will rise by approximately 530,000 barrels per day by 2024.

5th - Oil prices have risen a bit due to increasing tensions in Russia and more strikes in the Middle East. After an attack on US forces in Jordan, the US is planning to retaliate with additional strikes in Iran. Additionally, last week, the US imposed sanctions on 520,000 barrels of Iranian oil. Furthermore, two Ukrainian drones targeted Russia's largest oil refinery yesterday, adding to the uncertainty in oil supply.

7th - As per a recent report from the Energy Information Administration (EIA), the oil market is expected to reach a balance, and prices are likely to stay the same in 2024. The forecasted growth in US oil production for this year has been adjusted to 170,000 barrels per day, down from the earlier prediction of 1 million bpd.

9th - Oil prices are up this morning and are on track for a weekly gain. Brent crude is currently trading at $81.77. The increase in prices is attributed to rising tensions between Israel and Hamas. Israel's rejection of Hamas' ceasefire offer has added to market volatility. Investors are concerned about the potential extension of the conflict to other Middle Eastern nations, which could impact oil exports, contributing to the uncertainty.

12th - Oil prices are a bit down, even with the ongoing Middle East conflict. Strikes happened in Gaza over the weekend, and the Israeli prime minister's decision not to call a ceasefire increased tensions. Additionally, there's a rise in demand in the United States, with domestic production hitting a record 13.3 million barrels per day last week.

15th - Oil prices are lower today, currently at $81.6. The Energy Information Administration (EIA) announced a notable increase of 12 million barrels in US crude oil inventories, going against investor predictions of a 2.6-million-barrel rise.

22nd - This morning, Brent crude oil is priced at $83.45, showing an increase. Despite a nearly 7 million barrel growth in US crude oil reserves last week, prices are still going up due to expectations of increased demand in the US as the dollar weakens.

26th - This morning, oil prices are around $80.34, and there's uncertainty in the market due to the expectation of higher-than-anticipated inflation figures in the USA. Despite some positive factors like ongoing attacks on LNG and oil vessels in the Red Sea, prices are relatively low.

27th - After falling more than 2% last week, oil prices bounced back and are now trading at $81.75. This was influenced by a Federal Reserve member stating that US interest rates will stay higher for an extended period and the Houthis group's failed attempt to attack a US tanker in the Gulf of Aden, highlighting the ongoing tension in the Red Sea region.

Get in Touch

Our team are independent energy advisors who provide competitive gas, electricity, and water prices for commercial businesses across the region.

Our complete energy management service also includes helping businesses to identify potential savings through energy audits, tax levy rebates and grant funding. We can also help you plan for Net Zero and achieve compliance with our in-house ESOS assessment service.

Contact us for a free initial consultation about your business energy.

0114 327 2645

Comments