Geopolitics Drive UK Energy Prices

- Professional Energy People

- 33 minutes ago

- 6 min read

UK Energy Market Update

January 2026

Market Summary

EU gas storage fell sharply in January, dropping from about 61% to around 41% by month-end, well below the five-year average. Prolonged cold drove heavy withdrawals, particularly in Northern and Western Europe, with France, Germany and the Netherlands seeing the largest declines, while LNG inflows offered only limited support. By month-end, inventories were unusually low for the season, leaving supply buffers tight and increasing concern over end-of-winter resilience.

Efforts to broker peace between Ukraine and Russia continued but made little progress, with US-led talks failing to resolve key disputes over territory and security guarantees. Moscow signalled openness to negotiations, while Kyiv held firm on sovereignty, keeping tensions elevated. For UK energy markets, the stalemate supported higher gas and power prices as traders priced in ongoing risks to Ukrainian energy infrastructure and wider European security.

US actions in early January, including the capture of Venezuelan President Nicolás Maduro and seizures of Venezuela linked oil tankers, briefly added geopolitical risk and volatility to global oil markets. While Venezuela produces only a small share of global supply, its vast reserves created uncertainty over future output and OPEC+ dynamics. The impact on UK gas and power prices was limited, but the episode reinforced structural risk premia and the sensitivity of European energy markets to geopolitical shocks.

Rising US-Iran tensions in January, driven by unrest in Iran and President Trump’s rhetoric, raised fears of disruption to the Strait of Hormuz, a vital route for around 20% of global LNG and a major share of oil exports. This boosted Brent crude and European gas prices, putting upward pressure on UK gas and electricity costs as traders factored in the risk of tighter global supply.

US-EU tensions rose in January after President Trump threatened tariffs on the UK and EU over Greenland, raising trade war concerns and highlighting Europe’s reliance on US LNG. For UK energy markets, sentiment weakened and gas prices fell briefly as traders downgraded industrial demand, before easing when Washington softened its stance at Davos.

Norway’s oil and gas production is expected to remain broadly stable through 2026 but is forecast to decline sharply toward 2030 as major projects mature and investment slows. Total output could fall from around 4.1 million barrels of oil equivalent per day in 2026 to under 3.5 million boe/d by 2030, with natural gas production peaking at 123 bcm this year before gradually tapering. For UK energy markets, this signals a longer-term tightening of European gas supply, which could support higher gas and power prices and increase reliance on alternative imports, including LNG.

Great British Energy (GBE) has unveiled a five-year plan to deliver at least 15 GW of low-carbon generation and storage by 2030, enough to power nearly 10 million homes. The strategy, supporting the Government’s Clean Power 2030 goals, includes over £15 billion in investment, creation of 10,000+ jobs, and a focus on offshore, onshore, and community energy projects to expand renewable capacity and benefit local communities. GBE’s plan positions the company as a key driver of the UK’s transition to a low-carbon energy system.

Net Zero News

New analysis by property consultancy Vail Williams shows that 74% of businesses have not yet evaluated how climate change could affect their operations, highlighting a widespread lack of preparedness among UK firms for growing climate-related risks.

The UK’s most recent Contracts for Difference (CfD) Allocation Round 7 has awarded contracts for 8.4 GW of offshore wind, marking the largest single offshore wind procurement ever achieved in both Britain and Europe.

In 2025, Britain edged closer to a zero-carbon electricity system as renewables hit record levels, with new National Energy System Operator data highlighting the growing role of clean power in ensuring energy security and affordability.

Global fossil fuel demand is projected to grow by under 1% in 2026, a sharp slowdown from 2025, while solar and wind output is set to rise over 17% during the same period.

Global nuclear power is set for its largest expansion in decades, with capacity potentially reaching 1,446 GW by 2050, surpassing the COP28 target of 1,200 GW, as countries embrace reactors for climate goals and energy security.

In 2025, wind and solar overtook fossil fuels for the first time in the EU, supplying a record 30 percent of electricity compared with 29 percent from fossil fuels, according to Ember.

In 2025, Britain’s nuclear plants generated 32.9 TWh, meeting about 12% of electricity demand, down 12% from 2024 mainly due to a prolonged Hartlepool outage, according to EDF.

Half of surveyed organisations prioritise innovation, with key energy-saving strategies including efficiency upgrades, smart energy management, renewable tariffs, onsite generation, and commercial EV charging. These measures cut costs, boost energy independence, and enhance sustainability credentials.

Over 500,000 households and businesses on heat networks are now covered by consumer protection rules for the first time, ending years of minimal oversight and unexpected price increases.

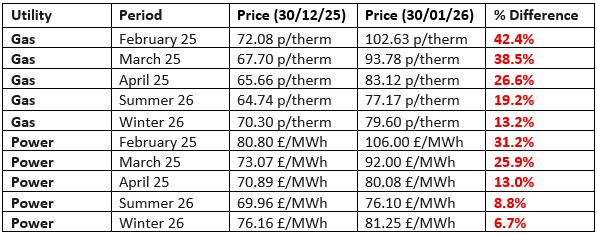

Electricity & Gas Prices

UK wholesale gas and electricity prices rose sharply over January, driven by persistent cold across Europe, rapid declines in EU gas storage, and heightened geopolitical tensions, particularly around Ukraine, Iran, and Venezuela. Bullish factors such as strong seasonal demand, tight supply buffers, and elevated risk premiums outweighed bearish influences including steady LNG imports, Norwegian flows, and periods of strong renewable generation. As a result, both gas and electricity contracts ended the month significantly higher.

Flexible Purchasing

EPEX Price

Some of our flexible purchasing customers are buying on EPEX, a European auction for power. Because they auction every hour of each day, customers get the “market average” price as opposed to a fixed-term contract over e.g. a 12-month period. Being on this product means that you will pay the average of each day for the month and once the market falls the price will follow.

The EPEX price finished the month with an average of 9.39 p/kWh (commodity). With the non-commodity added to this, the overall rate will be around 21.89 p/kWh+.

Carbon Prices

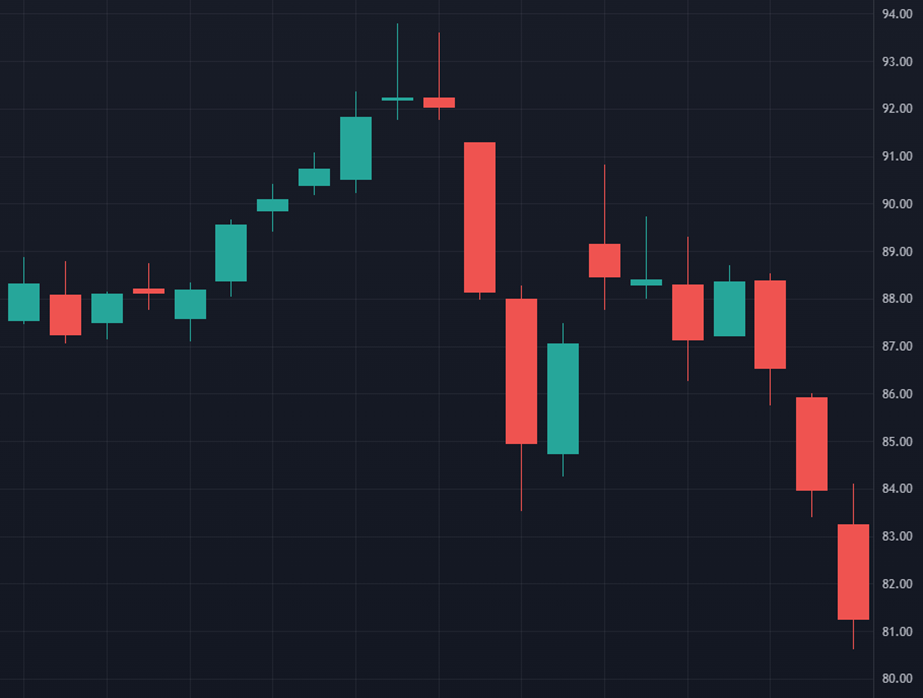

In January 2026, EUA carbon prices averaged approximately €89 per tonne, up from December’s average of around €86/tonne.

The increase was driven by a strong start to the year, with prices breaking above €90/tonne mid-month for the first time since mid-2023. Robust demand in weekly auctions, speculative fund positioning, and expectations of tighter supply under ongoing EU ETS reforms supported the rally. Structural policy drivers, including the launch of the Carbon Border Adjustment Mechanism (CBAM), also reinforced bullish sentiment and compliance demand.

However, prices eased back later in the month as profit-taking emerged and broader weakness in energy markets reduced near-term support. This pullback tempered gains, leaving the market higher on average but more range-bound toward month-end.

Oil Market

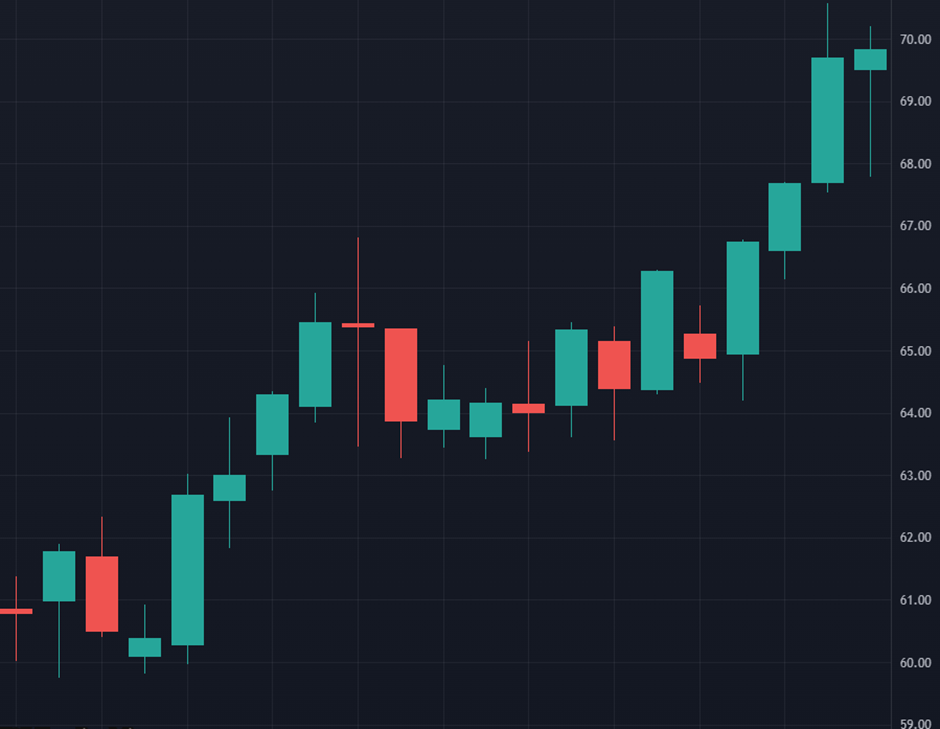

In January 2026, Brent crude prices averaged around the mid-$60s per barrel, rising sharply over the month and ending near six-month highs after significant geopolitical-driven volatility.

Prices strengthened early in the month on renewed geopolitical risk in the Middle East, particularly concerns over potential supply disruptions linked to unrest in Iran and US military rhetoric. Uncertainty surrounding Venezuelan exports and temporary outages in Kazakhstan also supported prices, alongside colder US weather reducing short-term production. These factors helped Brent rally above $70/bbl late in the month, marking its strongest monthly performance since early 2022.

However, several pullbacks occurred as tensions periodically eased and supply fears moderated. Reports of potential dialogue with Iran, confirmation that Venezuelan and Kazakh output could resume, and expectations of rising global supply weighed on sentiment at times. A stronger US dollar and concerns over excess supply in 2026 also capped gains, prompting profit-taking after headline-driven spikes.

Overall, January was characterised by strong upside momentum driven by geopolitical risk premia, tempered by recurring corrections as markets reassessed the likelihood of sustained physical supply disruption.

Get in Touch

Our team are independent energy advisors who provide competitive gas, electricity, and water prices for commercial businesses across the region.

Our complete energy management service also includes helping businesses to identify potential savings through energy audits, tax levy rebates and grant funding. We can also help you plan for Net Zero and achieve compliance with our in-house ESOS assessment service.

Contact us for a free initial consultation about your business energy.

0114 327 2645

Comments